Top 10

insurance terms

All of the definitions are subject to the terms, limits and conditions of your policy contract, as well as the state in which you live.

Flat Tire Fix

1 |

Park on a safe flat, hard surface off the road and make sure to put on the emergency brake. |

2 |

Loosen the lug nuts half a turn with a tire iron, but don't take any of them off yet! |

3 |

Jack up the car. |

4 |

Remove the lug nuts and the wheel. |

5 |

Put on your spare* and partially re-secure the lug nuts. |

6 |

Lower the car. |

7 |

Finish tightening your lug nuts. Always tighten top to bottom, left to right (order shown). |

Tip

*Spares come in a full-size version and a smaller "donut," which is meant to replace only a back tire. If you get a flat front tire, remove a rear tire and replace it with the donut. Then replace your front tire with the rear tire.

9 Helpful Things

to have in your car

Hover overTap on a circle!

Jumper Cables

Tire Pressure Gauge

First Aid Kit

Water & Snacks

Disinfectant Wipes

Blanket

Phone Charger

Reusable Tote Bags

Umbrella

Did you know?

You can use kitty litter to get your car out of the snow or mud!Clear loose snow or mud around your tires, then sprinkle kitty litter around your tires for traction. |

Accident Checklist

You should never move an injured person unless he or she is in immediate danger.

Only take pictures if you can do so safely. Include all vehicle damage and the surroundings, and upload pictures to geico.com after you report the loss.

Only disclose your name, your insurance company, your policy number and GEICO's phone number to the other parties (other than the police). Make sure to collect:

• Date and Time

• Location

• Police Report Number

• Other Driver's License Plate Number, Insurance and Contact Info

If your car isn’t drivable, call GEICO to report the loss. GEICO will help you get your vehicle towed quickly.

Our helpful agents are available 24/7 to help guide you through the process. Report a claim by calling (866) 351-0266, on geico.com or via the GEICO Mobile App.

Smart Ways to Save Big

Go to geico.com for a fast, free quote for renters or homeowners insurance

Combine

& conquer

Protect your property

and you could score savings

with our Multi-Policy

Discount.

Do you rent?

Help safeguard all

of your possessions

with a renters

insurance policy.

Do you own?

The GEICO

Insurance Agency could

help protect your

house or condo.

Additional savings

Find out all the different

ways you could save at geico.com/discounts

Pay Painlessly

You’ve got options. Pick the plan that works for you at: geico.com/payments

Set up automatic

payments

Stop worrying about your

bills. Sign up with Electronic

Funds Transfer (EFT) or your

credit or debit card, and you’ll

never be late again.

Spread your payments out...

Choose the

number of

installments that

work for your life—and budget.

...or pay in full

Pay the full premium

by the policy

effective date and

you’re done! (And

you’ll avoid

installment charges.)

Go green

Sign up for paperless

billing and do it all

online. eBill and ePolicy

are great ways to keep

track of your payments

and policy documents.

Download our app

Pay your bill anywhere,

anytime, and sign up for

text alerts when

payments are due. Text

MOBILE to 43426 to

download now.

Message and data rates may apply.

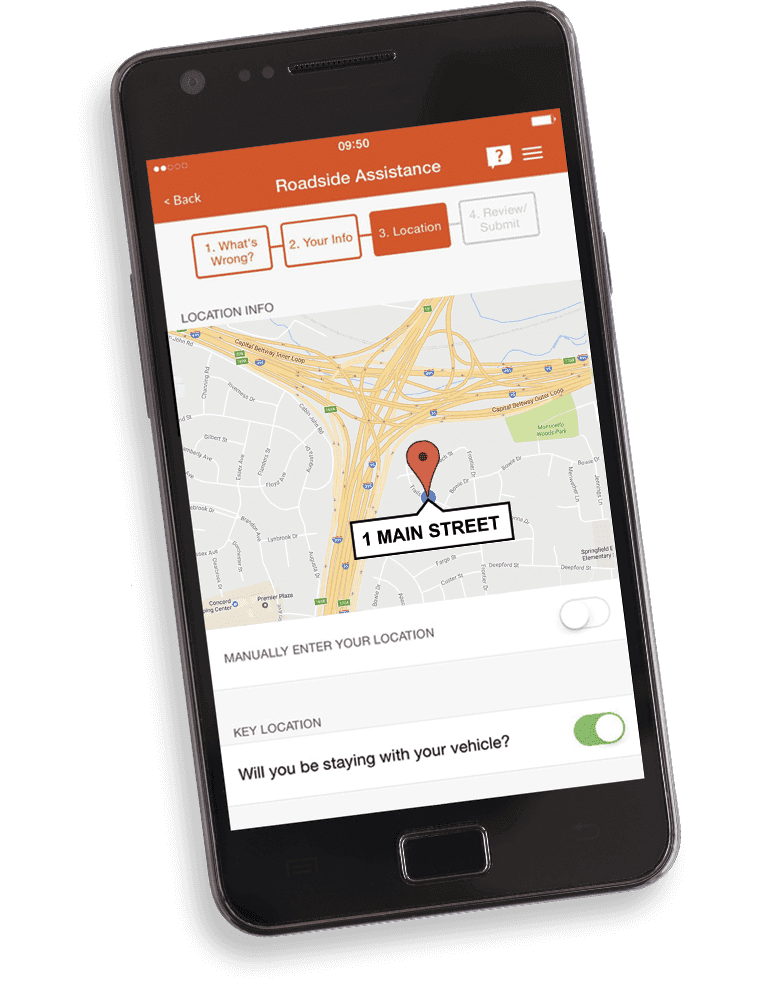

Roadside Assistance

Flat tire? Ran out of gas? Our Emergency Roadside Service (ERS) can help. Log in to your GEICO Auto Policy or call (800) 424-3426 to get a quote or add it to your policy.

We seeMore Savings in your future

Numbers to know

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Some discounts, coverages, payment plans and features are not available in all states, in all GEICO companies, or in all situations. Homeowners, Renters, Condo, Pet, Travel, Flood, Term Life, Jewelry, and business operations and property coverages are written through non-affiliated insurance companies and are secured through the GEICO Insurance Agency, Inc. Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. GEICO Auto policyholders could be eligible for a premium discount on their GEICO Marine Insurance policy. Motorcycle and ATV coverages are underwritten by GEICO Indemnity Company. GEICO Portfolio Identity Theft Protection is provided by Iris Powered by Generali and is secured through the GEICO Insurance Agency, Inc. Identity Theft Insurance is underwritten by Generali U.S. Branch. The GEICO Personal Umbrella Policy is provided by Government Employees Insurance Company and is available to qualified Government Employees Insurance Company and GEICO General Insurance Company policyholders and other eligible persons, except in Mass. Commercial auto coverage is underwritten by Government Employees Insurance Company. In some cases commercial auto coverage is provided through GEICO Insurance Agency, Inc., either under an arrangement with National Indemnity Company (NICO), a Berkshire Hathaway affiliate, or with non-affiliated insurers. Business operations and property coverages are written through non-affiliated insurers and are secured through GEICO Insurance Agency, Inc. The GEICO Mobile app and site received #1 rankings according to the Keynova Group Q1 and Q3 2021 Mobile Insurance Scorecards. If you do not wish to receive future marketing mailings from GEICO, please complete the form available at http://optout.geico.com/marketing, or send your full name and mailing address, including ZIP code, to Mail Preference, GEICO Marketing, One GEICO Plaza, Floor 4T, Washington, D.C. 20076. GEICO is a registered service mark of Government Employees Insurance Company, Washington, D.C. 20076; a Berkshire Hathaway Inc. subsidiary. GEICO Gecko image © 1999–. © GEICO