Commercial Auto Insurance

Get a customized commercial auto insurance quote for your business today.

Need a commercial auto insurance quote?

Make a Payment

Log inFind the right commercial auto insurance for your business.

Commercial auto insurance is a type of insurance policy that helps cover vehicles used for business, including cars, trucks, and vans. Commercial auto insurance covers vehicle damage and driver injuries.

Get your free online commercial auto insurance quote from GEICO today if you use your vehicle(s) for business purposes. With over 70 years of experience, we are dedicated to offering specialized coverage that suits your business at an affordable price.

No matter the size of your business, we'll customize a policy specifically for you.

More ways to save, more benefits, same full coverage with DriveEasy Pro.

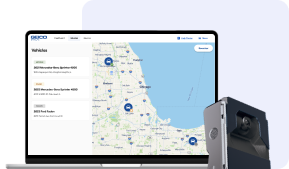

DriveEasy Pro is our commercial auto safe driving program that offers extra savings opportunities and exclusive benefits to help protect your business. DriveEasy Pro has a suite of offerings to fit your business's unique needs:

- Monitor fleet efficiency and real-time tracking with our OBD plug-in

- Extra protection for your truck with our road-facing dashcams

What is commercial auto insurance?

Commercial auto insurance covers business vehicles for things like:

- Damage to your vehicle(s)

- Driver injury

- Injury to someone else

- Damage to someone else's property

Commercial auto policies usually offer higher coverage limits than personal policies; this is because business vehicles require greater protection in the event of accidents. The policy limit for an insurance policy may vary based on the vehicle type. Speak to a GEICO insurance specialist to find the best coverage tailored to your needs.

Commercial auto insurance is similar to a personal auto insurance policy. It can cover liabilities, collisions, comprehensive, medical payments (or personal injury protection), underinsured (UIM) and uninsured motorists (UM). In some states, UM/UIM coverages are not required and can be declined in writing.

Note that there are differences between a commercial auto insurance policy and personal auto insurance policy. These differences include eligibility, definitions, coverages, exclusions, and limitations.

What type of vehicles are covered by commercial auto insurance?

- Cars

- Vans

- Pickup trucks

- Service utility trucks

- Food trucks

- Semi trucks

Additional types of commercial auto insurance?

The types of commercial auto insurance policies offered by GEICO are:

Who needs commercial auto insurance?

If you or your employees use your vehicle as part of your business, you need a commercial auto policy. We often cover vehicles used by:

- Electricians, plumbers, and HVAC professionals

- Carpenters, painters, and other contractors

- Landscapers and plow services

- Caterers and food vendors

- Long-haul Trucking

- Other business types, like real estate and sales

Without commercial auto insurance, you risk:

- Limited or no coverage for accidents while using your vehicle for business

- Paying out of pocket for repairs, injuries, and more

- Potential loss of your personal auto coverage

Getting a commercial auto insurance quote can be the first step in protecting you and your business. GEICO Commercial Auto Insurance covers your vehicle 24/7. That means whether you're working or not, your vehicle is protected!

What factors influence commercial auto insurance rates?

Various factors that increase the likelihood of filing a claim can influence commercial auto insurance rates. One significant factor is the driving records of the individuals operating the vehicles. A history of accidents, traffic violations, or DUIs can raise premiums due to the higher risk.

External variables like industry regulations, market trends, and insurance industry dynamics can also influence premiums. Understanding these factors is crucial for businesses seeking comprehensive and competitive commercial auto insurance coverage tailored to their needs.

GEICO's DriveEasy Pro program offers a participation discount and a free vehicle dashboard when you track your driving.

Learn more about DriveEasy Pro.

Why GEICO for commercial auto insurance? Savings, service, and experience.

GEICO commercial auto insurance comes with outstanding service, flexible ways to manage your policy, and competitive rates.

Outstanding service

Whatever your needs are, our commercial specialists can help you with things like:

- Adding or removing vehicles

- Updating drivers

- Adjusting coverage limits

- Adding insurance coverages like general liability

- Reporting and tracking claims

Online Policy Access

You can easily manage your commercial auto policy online. Log into your policy and you can:

- Make payments

- Enroll in autopay

- View payment history

- Check installment schedules

- Get ID cards or proof of insurance

Competitive Rates

We realize not all businesses are alike. GEICO's Commercial Auto policy gets you the best protection for your business at the best price for your budget. We'll help you with selecting:

- Coverage types

- Coverage limits and deductibles

- Vehicles

- Drivers

- Safe driving programs that offer more benefits with DriveEasy Pro

Need to speak with us?

You can get a commercial insurance quote by calling (866) 509-9444

-

Mon – Fri8:00 AM – 10:00 PM (ET)

-

Sat9:00 AM – 7:00 PM (ET)

Drive for Uber, Lyft, or another ridesharing platform? You need rideshare insurance instead. Please contact us at 866-904-5657 to get an insurance policy with the right coverage at a great price.

Commercial Auto Insurance FAQs: Get the answers you're looking for.

-

What does commercial auto insurance cover?In terms of coverage, commercial auto insurance is similar to personal auto insurance, but there are some differences, such as eligibility, definitions, coverages, exclusions, and limits. Find out what makes commercial auto insurance different, why you need it, what coverages are available.

-

Is commercial vehicle insurance required?Generally, vehicles used for purposes related to the operator's occupation, profession, or business require a commercial policy. This does not include commuting.

-

Why is commercial auto insurance important?Commercial auto insurance is important because it protects businesses from financial losses due to accidents, liability claims, or vehicle damage. It also minimizes operational disruptions by covering repair costs, medical expenses, and legal fees to safeguard assets and business reputation.

-

Are tools and materials in my vehicle covered under a commercial auto policy?A commercial auto insurance policy does not cover tools and materials transported in your vehicle unless they are permanently attached to it. In some cases, a business owner's or general liability policy may cover them.

-

If I have commercial auto insurance, who is covered to drive my commercial or business vehicle?Your commercial auto policy could cover employees, family members, and others as drivers. Learn more about our business car insurance.

-

What if I need certain liability limits for a contract?We can help with your policy liability limits questions and documentation needs. Look here to learn more about liability limits, and get more information about GEICO's commercial auto insurance.

-

Is my trailer automatically covered under my commercial auto policy?Depending on the size of the trailer and the policy, coverage will vary. Liability coverage is automatic for trailers weighing under 3,000 pounds, while physical damage coverage requires the trailer to be listed on the policy. Unless listed on the policy, trailers weighing more than 3,000 pounds or having multiple axles are not covered. Learn more about insuring a business vehicle, including trailers.

-

What types of businesses are eligible for commercial vehicle insurance?Various types of businesses are eligible for commercial vehicle insurance, including but not limited to transportation and delivery services, construction companies, retail businesses with delivery vehicles, and professional services that require vehicles for operations.

-

What is the difference between commercial car insurance and personal car insurance?Commercial car insurance is designed for vehicles used for business purposes, such as delivery trucks or company cars, and provides coverage for activities like transporting goods or employees. In contrast, personal car insurance is designed for individual drivers and their personal vehicles. It typically covers daily activities, such as commuting and running errands.

-

What other types of business insurance does GEICO offer?In addition to business auto insurance, GEICO offers a full line of business products you can review here.

Please note:

Some discounts, coverages, payment plans, and features are not available in all states or in all situations. GEICO is a registered service mark of Government Employees Insurance Company, Washington, DC 20076; a Berkshire Hathaway Inc. subsidiary. © 2020 GEICO